12 Best Financial Services LMS

Michael Keenan | WorkRamp Contributor

View bioLearning Tips Straight to Your Inbox

Financial organizations face a massive challenge in keeping employees trained and compliant with ever-changing laws and regulations. Finding a learning management system that meets their needs and keeps teams up to date without wasting time or resources feels impossible.

The wrong LMS can leave employees unprepared and organizations exposed to legal and financial risks. The right system, however, can streamline training, automate compliance tracking, and enhance knowledge retention across your teams.

In this article, we’ll compare the best financial services LMS platforms available and help you choose the one that best suits your organization’s needs.

In this post:

What are financial service LMS platforms?

Financial service LMS platforms are digital tools built for the financial industry to manage employee training and development. They help institutions deliver educational content, track progress, and ensure compliance with regulations.

Key features include:

- Course creation and management

- Compliance tracking

- Assessment tools

- Reporting capabilities

These platforms are used by banks, investment firms, and insurance companies for:

- New employee onboarding

- Ongoing professional development

- Regulatory compliance training

They allow financial institutions to maintain consistent training standards, reduce costs, and quickly adapt to industry changes. Employees can access training materials remotely, making it flexible for both office and remote work environments.

LMS features for streamlining financial services training

Below are the essential LMS features tailored to the demands of financial institutions:

Compliance management

Compliance management keeps you in line with industry rules. It tracks employee training, making sure everyone finishes required courses on time.

The LMS can send reminders and create reports for checks so you can avoid breaking the rules and facing fines. Admins usually have a screen that shows who has completed their training and who hasn’t.

For instance, this feature can guarantee all staff completes their yearly training on preventing money crimes. While useful, the LMS needs regular updates to keep up with changing rules.

Content & course creation

This feature lets trainers easily build custom learning materials. They can design courses on specific financial topics or compliance needs, making interactive lessons, quizzes, and simulations that engage learners. Many LMS providers also offer pre-made content you can customize and use, saving you time and money when creating and updating content.

For instance, a bank could quickly create a course on new anti-money laundering rules. While these tools are powerful, they may take some practice to use well. Overall, they help organizations deliver more effective and targeted financial training.

Role-specific training

Role-specific training tailors learning to each employee’s job. It matches courses to workers’ roles, so they can apply learnings more effectively. The LMS can use job titles or duties to assign relevant training automatically.

For example, loan officers learn about mortgages, while tellers study cash handling. This ensures employees get the right knowledge for their tasks and helps them thrive in their roles.

Targeted assessments

Targeted assessments are custom-built tests that zero in on specific skills or knowledge areas. They help spot where employees excel or need help with financial concepts and rules.

These assessments present real-world scenarios or questions that match different job roles or teams. For instance, investment advisors might face questions about managing risks and building portfolios.

By using these tests, you can make better training plans, stay on top of regulations, and boost overall job performance.

Enterprise-grade security

Enterprise-grade security protects sensitive data in online learning platforms. This feature uses strong encryption, multi-factor authentication, and strict access controls to keep information safe.

Financial service LMS need to obtain various certifications:

- SOC 2 (Service Organization Control 2): Ensures systems are set up to protect sensitive customer data.

- ISO/IEC 27001: An international standard for information security management systems (ISMS).

- GDPR (General Data Protection Regulation): For LMS platforms operating in or serving clients in Europe, GDPR compliance is necessary to protect personal data and uphold privacy rights.

- PCI-DSS (Payment Card Industry Data Security Standard): Mandatory for LMS platforms handling payment data to protect cardholder information.

Advanced reporting

Reporting gives managers a clear picture of training progress. It creates detailed reports on how well employees are learning, finishing courses, and passing tests. This helps leaders spot areas where the team needs to improve and make smart choices based on data.

Best financial services LMS

Now that you understand the key features to look for, explore the top 11 financial services LMS options below:

- WorkRamp

- Maple LMS

- AbsorbLMS

- Litmos

- Docebo

- ProProfs Training Maker

- TalentLMS

- LearnUpon

- eFront

- Paradiso Solutions

- Tovuti

1. WorkRamp

Introducing The Learning Cloud

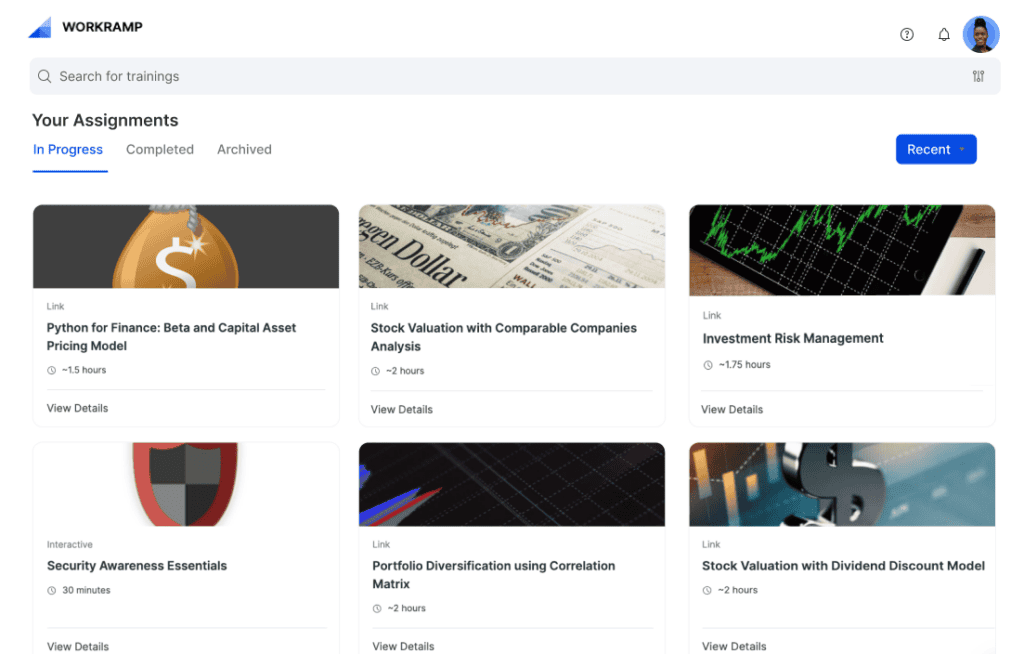

WorkRamp’s Learning Cloud offers financial services organizations a user-friendly, comprehensive platform to tackle their most pressing training challenges.

Using WorkRamp is intuitive and efficient. Admins can easily set up training programs, while employees enjoy on-demand access to both required compliance modules and optional development resources. The platform’s automated notifications keep everyone on track with regulatory requirements.

WorkRamp allows you to create tailored learning paths, white-label the interface to match their brand, and even set up multiple learning portals within a single account.

CAPTION: WorkRamp user dashboard

You can use WorkRamp to:

- Deliver annual compliance training on anti-money laundering regulations

- Onboard new employees with role-specific learning paths

- Provide ongoing professional development for financial advisors

- Train customer service representatives on new financial products and services

- Certify partners and resellers on your offerings

- Build a customer community to encourage engagement

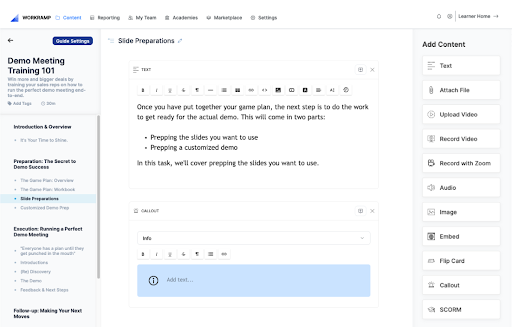

Content creation is a breeze, blending custom materials with a rich library of prebuilt financial sector content. This allows for quick deployment of role-specific training that covers both compliance and skill development.

CAPTION: WorkRamp user creating content

Clear, customizable dashboards make reporting straightforward, offering instant visibility into learning progress and simplifying audits.

Overall, WorkRamp offers financial institutions a streamlined solution that adapts to the industry’s evolving needs, balancing compliance requirements with continuous learning. Its extensive feature set and flexibility make it well-equipped to handle the diverse learning needs of large, distributed workforces.

Key features:

- Automated compliance management

- Customizable industry-specific content

- Self-service learning libraries

- Enterprise-grade security

- Comprehensive reporting tools

- Seamless tech stack integration

- Mobile-friendly access

Looking for a powerful, all-in-one learning management system to elevate your financial services training? WorkRamp offers customizable solutions that streamline learning, ensure regulatory adherence, and boost employee performance.

Schedule a demo today to see how WorkRamp can transform your training processes and keep your team at the top of their game.

2. Maple LMS

MapleLMS streamlines financial services training with a focus on security and compliance. The platform offers up-to-date regulatory and cybersecurity content through engaging, gamified lessons.

Its AI proctoring ensures assessment integrity, while easy integration with CRMs and HR systems simplifies LMS implementation. Automated reporting helps track employee progress and compliance status.

With mobile support and personalized learning, MapleLMS adapts to the demanding schedules of finance professionals, boosting performance and regulatory adherence.

Key Features:

- Robust compliance management

- AI-powered secure assessments

- Seamless integration with existing systems

- Automated tracking and reporting

- Industry-specific course content

- Mobile-friendly learning

- Personalized training paths

3. AbsorbLMS

AbsorbLMS is an excellent solution for financial services training, offering a streamlined and intuitive platform for both internal teams and external partners. It automates compliance training and enhances skill development through AI-driven personalized learning.

For financial institutions, Absorb’s extended enterprise capabilities provide scalable training solutions for customers and partners, ensuring that all training aligns with industry regulations. Its mobile-friendly design lets learners engage with content anytime and anywhere.

A standout feature of Absorb LMS is its advanced analytics suite, which helps organizations track training effectiveness and ROI. Seamless integration with existing HR and CRM systems ensures that training efforts are aligned with broader business goals. The platform also supports multiple languages, making it a global solution for learning.

Absorb LMS empowers financial institutions to build agile, compliant teams capable of tackling industry challenges, offering a scalable, customizable, and data-driven learning experience.

Key Features:

- AI-powered personalized learning

- Robust compliance management

- Extended enterprise capabilities

- Advanced analytics and reporting

- Seamless system integrations

- Finance-specific content library

- Mobile-friendly design

4. Litmos

Litmos offers a learning management system tailored for the financial sector, including banking, insurance, and real estate.

Litmos stands out with its rapid deployment and seamless integration capabilities. With over 50 pre-built connectors and open APIs, it easily fits into existing tech ecosystems. The system’s universal accessibility is impressive, offering round-the-clock online and offline access in 35+ languages.

Customization is a key strength. Firms can fully brand the interface and create role-specific dashboards, reinforcing their identity while delivering personalized learning experiences. Content creation is a breeze with built-in authoring tools that produce engaging, mobile-friendly SCORM content.

Automation is another highlight, with AI-enhanced features streamlining processes like alerts, assignments, and reporting. The AI-powered video assessment tool offers personalized feedback, adding another layer of sophistication to the training experience.

Key Features:

- Compliance and regulatory tools

- Industry-leading security features

- Custom UI branding and dashboards

- Robust reporting and analytics

- Built-in content authoring

- Universal accessibility

- AI-powered workflow features

5. Docebo

Docebo stands out with its vast library of over 20,000 courses and certifications, addressing the financial industry’s talent gap in tech roles. The platform’s strong security measures, version controls, and localization tools effectively mitigate risks and ensure ongoing compliance.

Going beyond employee training, Docebo enables tailored learning for customers and partners, potentially boosting revenue and retention. Its advanced analytics tie learning directly to key performance metrics, so you can determine real business impact.

User-friendly and compatible with existing systems, Docebo streamlines workflows and can reduce overall L&D costs. This comprehensive approach positions financial firms to thrive amidst industry disruptions through flexible, data-driven learning solutions.

In essence, Docebo offers a powerful, adaptable LMS that aligns well with the evolving needs of modern financial services companies.

Key Features:

- Robust compliance and security tools

- Personalized learning experiences

- Extensive content library and certifications

- Multi-audience support (employees, customers, partners)

- Advanced analytics and reporting

- Easy integration with existing systems

- Automated recertification management

6. ProProfs Training Maker

ProProfs Training Maker is a versatile learning management software tailored for financial services and other industries. It offers a comprehensive suite of features for creating, delivering, and tracking online training programs.

Users can easily upload existing content (PDFs, videos, presentations) or use pre-built courses. It offers features like quizzes and assessments to enhance learning retention.

ProProfs stands out for its flexibility. It supports various training needs, from employee onboarding to compliance and skill development. The system’s ability to manage multiple user groups and assign specific roles makes administration easier.

Users praise its ease of use, comprehensive feature set, and helpful customer support. Some reviewers noted a slight learning curve due to the abundance of features, but most found it manageable with time.

While generally well-received, some users mentioned wanting more educational templates and a longer trial period.

Key Features:

- User-friendly interface

- Extensive course library and customizable templates

- Robust compliance and security tools

- Multi-language support (35+ languages)

- Mobile-friendly learning

- Advanced reporting and analytics

- Integration capabilities (including SSO and LDAP)

7. TalentLMS

TalentLMS is an award-winning cloud-based platform that provides a flexible and scalable solution for delivering training to financial sector employees, partners, and customers.

You can easily track mandatory training completions, automate reminders for certification renewals, and generate compliance reports. Plus, white-label the platform and customize the look and feel to match your financial institution’s branding.

The intuitive interface makes it easy for administrators to manage users, create courses, and generate reports without extensive technical knowledge. Meanwhile, learners benefit from an engaging and user-friendly experience across devices.

While some users note that advanced customization may require technical skills, overall TalentLMS offers a powerful yet accessible platform for financial services training needs. Its combination of essential features, security, and ease of use make it a strong contender for organizations in this highly regulated industry.

Key Features:

- Compliance and certification management

- Customizable branding

- Robust security measures

- Mobile learning capabilities

- Comprehensive reporting and analytics

- Multi-tenancy (branch system)

- Integration capabilities with other systems

- Support for various content types

8. LearnUpon

While not built specifically for financial services, LearnUpon is another top LMS option. With over 1,500 customers and millions of users, LearnUpon has clearly established itself in the market. The various awards and recognitions, including those from G2 and Brandon Hall, lend credibility to their claims of quality and customer satisfaction.

Pricing is straightforward and competitive, based on active users rather than total accounts. This model allows companies to onboard their entire workforce without immediate cost implications, only charging for employees who engage with the platform.

The standout feature is LearnUpon’s comprehensive e-commerce integration. Supporting various payment systems and even Shopify empowers training companies and individual instructors to monetize their content easily.

LearnUpon’s learner experience is also engaging and modern. The customizable dashboard supports rich media, including videos and GIFs, adding a touch of personality to the learning environment. Gamification elements like badges and leaderboards further boost user engagement.

While the platform excels in many areas, there’s room for improvement. The module-based course creation process can be time-consuming, and the quiz creation options are somewhat limited.

Key Features:

- Multi-audience training support

- AI-powered learning for automation and personalization

- Centralized management for course creation, delivery, and tracking

- User-friendly interface focused on learner engagement

- Robust reporting and analytics tools

- Integration capabilities with other business systems

- Mobile accessibility through “LearnUpon Anywhere”

9. eFront

eFront is a robust and highly secure learning management system designed to meet the complex training needs of large enterprises.

eFront provides a scalable solution that can handle complex organizational structures through features like branches, custom user roles, and learning paths. The platform is highly flexible, allowing companies to create tailored learning portals for different audiences.

While the user interface is described as straightforward, some users may find it less visually appealing or intuitive compared to more modern SaaS LMS designs. However, eFront makes up for this with its rich functionality and ability to handle sophisticated training requirements.

eFront costs $1,200/month for up to 1,000 users, making it best suited for larger organizations. It offers transparent, all-inclusive pricing with all features available at every tier.

Key Features:

- Advanced security features (IP whitelisting, SSO, two-factor authentication)

- Powerful reporting and analytics engine

- Skill gap testing and employee development tools

- Customizable learning portals and branding

- Extensive integration capabilities

- Mobile learning support with native app

- Gamification and certification features

10. Paradiso Solutions

Paradiso LMS is a cloud-based learning management system built on Moodle’s open-source framework. It offers robust security features, including SOC2 and ISO 27001:2013 certifications, which are critical for financial sector clients.

One strength of Paradiso Solution is its customization options. You can completely customize the platform’s look and feel through CSS, HTML, and JavaScript modifications. It also integrates with various third-party tools, including Salesforce, SugarCRM, WordPress, and popular webinar services.

Some users say the platform is clunky and not intutive. It also lacks onboarding tours for admins, so it can feel difficult to get started.

Key Features:

- Robust security features and certifications

- Compliance training capabilities

- Extensive customization and white-labeling options

- Wide range of third-party integrations

- Mobile learning support

- Gamification elements

- E-commerce functionality for selling courses

11. Tovuti

Tovuti’s user interface is generally praised for its intuitiveness, especially from the learner’s perspective. However, some administrators report a steeper learning curve when first setting up and managing the platform.

The LMS boasts impressive integration capabilities, with over 2,000 API integrations available. It allows seamless connection with popular platforms like Salesforce, BambooHR, and Workday.

Content creation and management are streamlined in Tovuti. The platform provides access to over 30,000 pre-built courses, allowing you to quickly implement training programs. Additionally, Tovuti also offers AI-generated content creation, helping you rapidly deploy courses, quizzes, and lessons.

Another significant advantage of Tovuti is its built-in virtual classroom functionality. This feature allows for seamless integration of live online training sessions within the platform, which is especially valuable for organizations embracing remote or hybrid learning models.

One area where Tovuti particularly shines is its customer support. Many users praise the responsiveness and helpfulness of the Tovuti support team, citing quick issue resolution and thorough assistance during the implementation process.

Key Features:

- Fast implementation and customization

- Extensive integration capabilities

- Mobile learning support

- Access to 30,000+ pre-built courses

- AI-generated content creation

- Robust compliance and security features

- Comprehensive reporting and analytics

12. Dokeos

Dokeos is a compliance LMS designed specifically for highly regulated industries like financial services, healthcare, pharmaceuticals, and life sciences. It handles strict compliance requirements through features like issue certifications, training tracking, and audit-ready documentation.

Whether it’s e-learning modules, quizzes, or in-person training, the platform provides a variety of formats to engage learners effectively. Organizations can also brand the solution to align with their corporate identity.

Dokeos also integrates several anti-fraud measures, such as randomizing questions, limiting attempts, and adding electronic signatures at the end of tests. These features are invaluable for industries like finance, where the authenticity and integrity of training evaluations are essential for maintaining compliance with stringent regulations.

Key Features:

- Regulatory compliance (e.g., FDA 21 CFR Part 11)

- Customizable training paths

- White-label solution

- Certifying evaluations with anti-fraud measures

- Data-driven performance analysis

- Customizable certificates with expiry dates

- Collaboration and knowledge sharing

Choose the best LMS for finance & banking

The right financial services LMS is key to maintaining a smart and compliant organization. After comparing the top platforms, WorkRamp stands out as the best choice. It offers user-friendly tools for compliance, training, and tracking progress, making it the best option to keep your team up-to-date and performing well.

Complete the form for a custom demo.

Recent Posts

- Onboarding with an LMS: How to Set New Hires Up for Success July 16, 2025

- Why Secure LMS Platforms Are a Must for Regulated Industries July 10, 2025

- Top LMS Integrations That Power Smarter, Faster Learning July 2, 2025

- Introducing WorkRamp Analytics Studio: Unlocking Your Data Insights with AI June 30, 2025

- 11 AI LMS for AI-Powered Learning June 27, 2025

Michael Keenan

WorkRamp ContributorMichael is a SaaS marketer living in Guadalajara, Mexico. Through storytelling and data-driven content, his focus is providing valuable insight and advice on issues that prospects and customers care most about. He’s inspired by learning people’s stories, climbing mountains, and traveling with his partner and Xoloitzcuintles.

You might also like

Faster Onboarding with a Scalable LMS

When you’re scaling fast, onboarding can’t slow you down. Whether you’re hiring five new reps or fifty, the first few weeks are critical—not just for productivity, but for long-term retention. But here’s the challenge: most onboarding programs are time-consuming, inconsistent, and tough to scale. That’s where a Learning Management System (LMS) changes the game. Onboarding […]

Read More

Why Secure LMS Platforms Are Critical for Regulated Industries

Regulated industries live under a microscope. Whether you’re safeguarding patient data in healthcare, protecting investor information in finance, or documenting every lab result in life sciences, a single training slip‑up can trigger fines, lawsuits, and reputational fallout. That’s why your Learning Management System can’t be just a training portal, it has to be a rock‑solid pillar of […]

Read More

Top LMS Integrations That Power Smarter Training

An LMS is only as powerful as the tools it connects with. To maximize your LMS, it should integrate seamlessly with the tools your team already uses, like your CRM, HRIS, or communication apps. The right integrations reduce manual work, personalize learning, and help tie training directly to business outcomes. In this guide, we’ll walk […]

Read More

WorkRamp launches Analytics Studio for AI-powered reporting and visualizations

At WorkRamp, we believe that learning should be measurable and deeply aligned with business goals so you can show your impact. That’s why we’re thrilled to launch our new Analytics Studio, a robust, AI-driven reporting engine now available across the WorkRamp platform for employee and customer learning. The days of exporting static reports and manually […]

Read More

Explore the top AI LMS platforms for advanced AI-powered learning. Enhance education with smart, adaptive technology solutions.

Explore the top AI LMS platforms for advanced AI-powered learning. Enhance education with smart, adaptive technology solutions.

Read More

The Top 3 LMS Platforms for Customer Retention in 2025

Looking to turn new customers into loyal advocates? The right Learning Management System (LMS) can help you do just that by boosting satisfaction, reducing churn, and even driving revenue growth. Here’s why it matters: keeping customers is 5–7 times cheaper than acquiring new ones, and just a 5% increase in retention can lead to a […]

Read More